Texmaco Rail & Engineering Ltd receives order worth Rs. 219.18 crores

Texmaco Rail & Engineering Ltd receives order worth Rs. 219.18 crores HFCL secures Purchase Orders worth ~INR 60.95 crore for supply of Optical Fiber Cables

HFCL secures Purchase Orders worth ~INR 60.95 crore for supply of Optical Fiber Cables Highway Infrastructure Ltd receives LoA of Rs. 154.59 crores

Highway Infrastructure Ltd receives LoA of Rs. 154.59 crores EKI Energy Services Ltd featured among Top Global Renewable Energy Carbon Credit Suppliers in Abatable's 2026 Carbon Market Report

EKI Energy Services Ltd featured among Top Global Renewable Energy Carbon Credit Suppliers in Abatable's 2026 Carbon Market Report Shraddha Prime Projects Ltd to enter into Development Agreement for new project

Shraddha Prime Projects Ltd to enter into Development Agreement for new project

Stock Report

Suryoday Small Finance Bank Ltd - Q3FY24 BusinessUpdate

Posted On : 2024-01-04 15:46:41( TIMEZONE : IST )

Suryoday Small Finance Bank Limited has announced the business update for period ended December 31, 2023.

Management Commentary

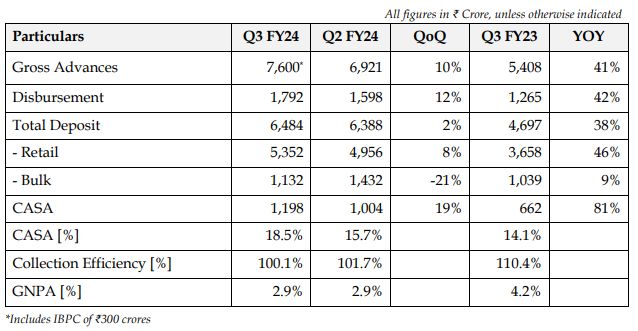

The Bank has witnessed substantial growth in all performance parameters, both sequentially and on an YoY basis.

The Disbursements are on track as per FY24 guidance. The disbursements as on 9M FY24 stood at ₹4,580 crores as compared to ₹3,396 crores in 9M FY23 (YoY growth of 35%), on the back of an uptick in Vikas Loan as well as Retail Assets disbursements.

Vikas Loan book crossed ₹2,000 crores mark in Q3 FY24.

The Bank's commitment to build a strong retail liability book was displayed by a rise in CASA % on a QoQ basis by approx 280 bps (approx ₹200 crores).

The Bank was able to maintain its Cost of Funds in Q3 FY24 on the back of stable Cost of Deposits and it has also witnessed an improvement in NIMs on a QoQ basis.

Please note that the numbers mentioned above as on quarter ended December 31, 2023, are provisional unaudited numbers and are subject to review / approval by the Audit Committee and Board of Directors. It is also subject to limited review by the Statutory Auditors of the Bank.

Shares of Suryoday Small Finance Bank Limited was last trading in BSE at Rs. 159.30 as compared to the previous close of Rs. 161.10. The total number of shares traded during the day was 43202 in over 941 trades.

The stock hit an intraday high of Rs. 160.45 and intraday low of 158.20. The net turnover during the day was Rs. 6887179.00.