Research

Railway stocks to get Steam in a run up to Budget

Posted On : 2025-12-29 15:59:20( TIMEZONE : IST )

Divyam Mour, Research Analyst, SAMCO Securities

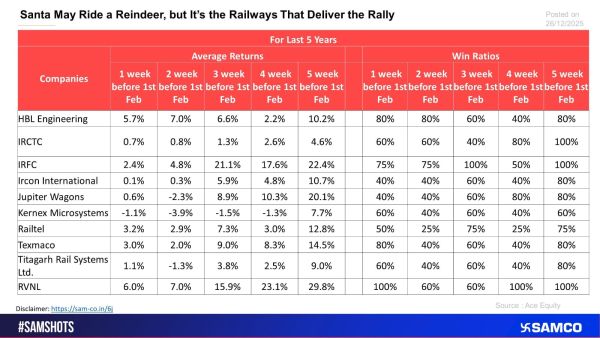

The data clearly highlights a recurring pre-Budget rally pattern in railway stocks, with meaningful price strength emerging from one week up to five weeks before the Union Budget, driven largely by expectations of government support for railway infrastructure and operational efficiency.

An analysis of the past five years indicates that most railway-linked stocks have generated positive average returns across multiple time frames, with only a few isolated exceptions, and the gains have largely been sustained over extended periods. Companies such as IRFC, RVNL, IRCTC, RailTel and select wagon and EPC players have consistently shown improving return profiles as the Budget approaches. Importantly, this is not just about returns, the probability of positive returns ie. win ratios also improve materially as the time window expands, signalling that this is a repeating seasonal phenomenon rather than a one-off spike. This indicates that market participants have increasingly begun pricing in railway-focused announcements ahead of the Budget, reflecting the sector's elevated strategic importance in recent years.

Fundamentally, this optimism is well supported. Railway fares have been increased for the second time in the current year and only the third time in the last five years, marking a clear shift towards revenue rationalization. Higher passenger and freight realizations improve the internal cash generation of Indian Railways, reducing dependence on budgetary support while simultaneously enabling higher capex. This incremental revenue pool enhances the Railways' ability to invest in efficiency, safety, and network expansion.

The upcoming Budget could therefore focus on railway safety upgrades, including higher allocations towards modern wagons, signalling systems and the Kavach anti-collision platform. In addition, dedicated freight corridors, logistics corridors and network decongestion projects could remain high on the government's agenda, further strengthening the medium-term outlook for railway ecosystem companies.

Overall, the data reinforces a clear message: pre-Budget optimism in railway stocks is not only real, but has become structurally stronger in recent years, supported by improving sector economics, policy intent and sustained capital allocation focus.

Anupam Rasayan Delivers Strong Q3 FY26 Performance

Anupam Rasayan Delivers Strong Q3 FY26 Performance Hind Rectifiers Posts Record Q3 FY26 Revenue

Hind Rectifiers Posts Record Q3 FY26 Revenue AvenuesAI Reports Record Q3 FY26 with 122% Revenue Growth

AvenuesAI Reports Record Q3 FY26 with 122% Revenue Growth Vipul Organics Reports Solid Q3 FY26 Growth

Vipul Organics Reports Solid Q3 FY26 Growth KFin Technologies Posts Robust Q3 FY26 Growth

KFin Technologies Posts Robust Q3 FY26 Growth