SAMHI Hotels Acquires 70% Stake in RARE India for Rs 47.39 Crore in Strategic Hospitality Move

SAMHI Hotels Acquires 70% Stake in RARE India for Rs 47.39 Crore in Strategic Hospitality Move KPI Green Energy Executes BESPA for 445 MW/890 MWh BESS Projects

KPI Green Energy Executes BESPA for 445 MW/890 MWh BESS Projects RailTel Secures Rs 26.73 Crore OFC Network Order from South East Central Railway

RailTel Secures Rs 26.73 Crore OFC Network Order from South East Central Railway P N Gadgil Jewellers Ltd opens new FOCO store at Navi Mumbai

P N Gadgil Jewellers Ltd opens new FOCO store at Navi Mumbai Kabra Drugs Limited rebrands as Aanjaay Industries, to enter into JV with Indonesian firm

Kabra Drugs Limited rebrands as Aanjaay Industries, to enter into JV with Indonesian firm

Mutual Funds

ESGrisk.ai Launches ESG Mutual Funds Research

Posted On : 2022-11-26 09:42:58( TIMEZONE : IST )

ESGrisk.ai, India's first ESG Rating provider, announces the launch of ESG Mutual Funds Research. The objective of the offering is to provide a comprehensive analysis of the composite ESG performances of ESG and Non-ESG Mutual Funds in India by looking at the ESG risk and other ESG considerations of constituent companies.

The mutual fund industry has dedicated ESG funds based on the environment, social, and governance (ESG) performance criteria set by the fund managers. Based on these criteria, they pick the best-performing companies to invest in. However, there is no standard parameter to compare their ESG performance. ESG Research on Mutual Funds addresses this gap and better equip fund managers to aid their adaptability with the fast-paced ESG evolution.

"We believe our ESG Research on Mutual Funds will help fund managers construct ESG funds and monitor the sustainability quotient of existing ESG as well as non-ESG funds. It will also help sustainability-oriented investors in fund selection for their investments," said Mr. Sankar Chakraborti, Chairman ESGrisk.ai, and CEO Acuité Group.

This initiative is in line with the regulatory moves to bring uniformity to ESG funds, which see huge amounts of inflows from investors.

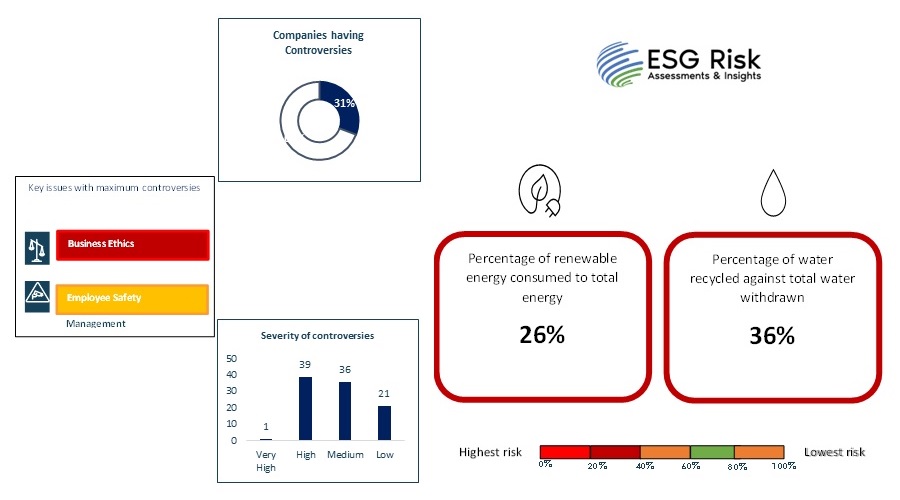

Citing insights from ESGRisk.ai's extensive ESG Research on Mutual Funds, Mr. Prosenjit Ghosh, COO, Subsidiaries, Acuité Ratings & Research, said, "ESGRisk.ai's analysis of portfolio companies of ESG mutual funds indicates renewable energy accounts for only 26% of total energy consumption. In addition, 36% of the water consumed is recycled. It is observed that 31% of the portfolio companies face controversies, the majority of which are high impact and pertaining to business ethics."